As more and more investors try and bring the commodity markets segment into their investment portfolios, most of them wonder why rice, which is one of the world's largest crops still lacks an investment vehicle. For all major commodities, there are futures markets and corresponding ETFs, but rice continues to be the only major commodity player that has no ETF mechanism in any stock exchanges in the world.

Like Lumber, which has very little liquidity or volume but is still considered to be a key future and ETF, rice is also a key future commodity because it is essentially an index of world consumption patterns, as rice is the most essential food for half of the world's population today. Since rice producers are not publicly traded companies one cannot purchase their stock directly, so an ETF for rice based on futures would be a good investment vehicle. A high number of rice market analysts also believe it is the right time to offer a rice oriented exchange traded fund which would not only attract many investors but would also provide grain traders with more risk control measures.

Time For Rice ETF: Oryza.com, the premier rice web portal which periodically publishes projections on rough rice trends and rice trade trends has also underlined the need for a Rough Rice ETF that can help US investors to enter the futures market with ease. Quoting from Oryza.com, the portal says

"Rice Exports are important to the U.S. rice industry, as the global market accounts for about half of its annual sales volume. U.S. rice imports have been increasing in the last 25 years, from about 4 percent of the domestic market in the second-half of the 1980s to more than 15 percent by 2008/09 (August-July). Unless you dabble in the futures market, there’s no real pure rice play for American investors. When rice hit record prices last year, investors wondered why there was no rice-based exchange-traded fund (ETF). More than a year later, they are still wondering why one of the world’s largest crops still lacks an investment vehicle of its own. US Rice futures traded at the Chicago Board of Trade, CBOT, continues to be the barometer for rough rice orientation worldwide, still there is no rice centric Exchange Traded Fund that can help investors to profit from the global rice situation. For investors trading in the commodity markets, all except rice futures have some ETFs or sub indexes to track but nothing for rice. Its time that rice, which is the world's second largest staple crop has its own ETF based on Rough Rice futures. Considering the vital importance of the most consumed cereal in the world, a RICE ETF could be very welcome and would play a role in creating a standard in global rice pricing."

Factors Affecting Rice Price Fluctuations:

Weather: Weather is an important factor for all agricultural commodities. To produce a high-yielding rice crop, growers require high heat, plentiful water and smooth land that facilitates flooding and drainage. Over the past few months, we’ve seen extraordinary weather events around the world with Thailand and Vietnam facing prolonged drought while China faced flash floods triggered by heavy rainfall even as neighboring India's monsoon rainfall has been below normal. South East Asia is estimated to have affected 61.3 million residents and 5 million hectares of crops. Rice has recorded relatively moderate gains of about 10 percent since this began. This pressure on supply is likely to further increase the price.

Government Control: Rice in modern times has also become a very politically sensitive crop. Unpredictable government intervention continues to add volatility to the thinly traded global rice market. The Chinese government watches food prices and supplies on a daily basis while India, one of the largest rice manufacturing nations, has continued its year long ban on all non Basmati rice exports in order to fight domestic inflation rates.

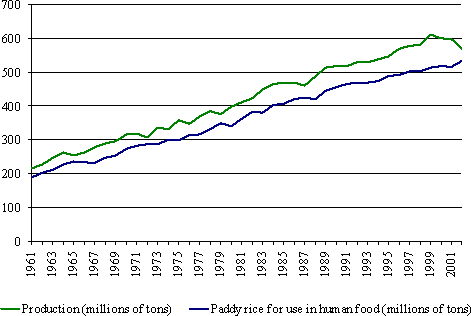

Evolution of the world production and human food utilization of the Paddy rice from 1961 to 2002 (million tons)

Visit www.worldmarketpulse.com for the full article or Click Here

No comments:

Post a Comment